Are you studying for your AP® Microeconomics Exam and need to understand better what externalities are? Well, look no further! In this crash course review, you will learn all you need to know about externalities for the exam.

What are Externalities?

In the world of economics, externalities or spillovers are the consequences of an economic activity incurred by third parties. It can also be defined as the result of an industrial or commercial activity that affects third parties without this being reflected in the cost of the good or service.

Externalities are one of the main reasons governments intervene in the economic field, because they create market failure, and the government steps in to correct or internalize those failures. Externalities are divided in production or consumption, and can be either positive or negative, depending on the environmental impact they cause.

Negative Externalities

Negative externalities happen when productions or consumptions create an external cost to third parties outside of the market, and no compensation is paid.

There are many examples of negative externalities as the result of production, where the social benefit is less than total output, creating a market failure. To correct those market failures, the government intervenes by way of taxation. One example of negative externalities in production is the destruction of the Amazon rainforest, where trees are cut for the manufacture of furniture or paper, creating an imbalance in the environment.

An example of negative externalities in consumption is environmental pollution. In the case of air pollution, the polluter does not consider the social factor of the cost that results from the polluted air, but rather in the cost of production. The indirect social cost of air pollution is a lower quality of life and associated health problems in the proximate society, which requires governmental intervention.

Externalities Market failure

Negative externalities cause market failure, which happens when the cost to society is greater than the benefit of the good, as the air pollution example. The health care cost related to living in a polluted environment exceeds the benefit of the good produced while causing the contamination, which creates a deadweight welfare cost in the market.

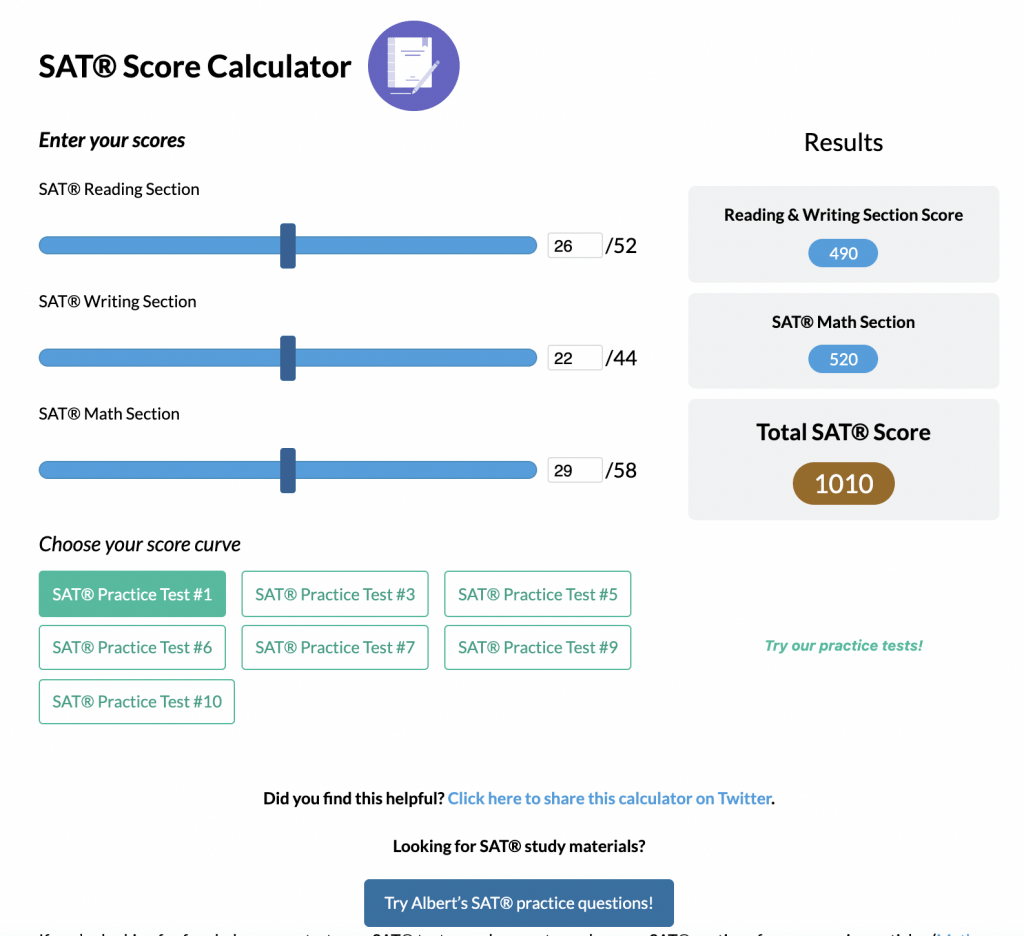

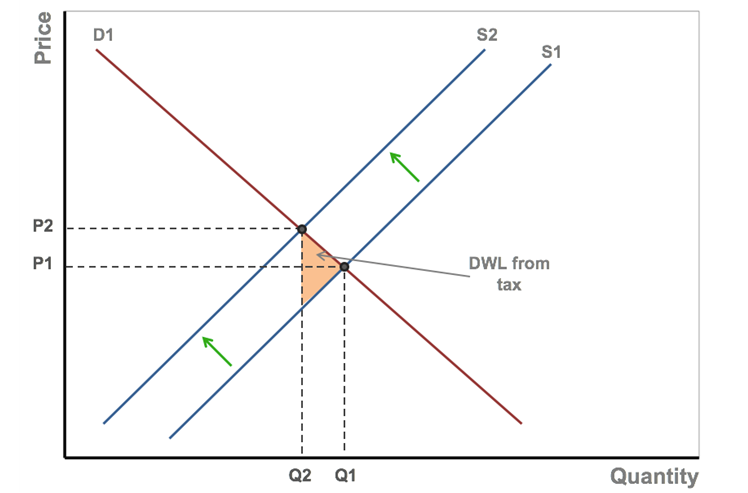

Let’s look at it in a graph. In this graph, P stands for the price, and Q stands for total production. There is a downward sloping demand curve. S1 represents private cost only, and S2 represents the private and social cost.

Q1 is where demand and supply meet, and social value is greater than social demand, which is Q2.

In a free market, external cost of others is ignored, and therefore, Q1 will be used.

This is socially inefficient because the social cost is greater than the social benefit. This is considered a market failure.

Social efficiency or optimum equilibrium is at Q2 where social cost and social benefit meet.

To correct the market failure, the government intervenes with taxing the producer of negative externalities. By taxing the producer, prices go up, and quantities go down, and the market failure is corrected or internalized.

Negative externalities can also be described as a property rights problem. Since the owner of a property normally is the one paying for its benefit, the question is; Who is the owner of the air that was polluted? Does the property owner have the ownership right over the air or the society living in the surrounding area?

To solve this problem, the government will step in and tax the producer for the social cost, driving down the output and increasing the cost.

Positive Externalities

Positive externalities are the opposite situation, where the benefit to society (third-parties) is greater than the core benefit to the producer from an economic transaction. Third-parties include any individual, organization, property owner, or resource that is indirectly affected. It is when third parties benefit from the consequences of a firm or an individual’s action.

For example, if a farmer plants an apple tree, bees from a nearby beekeeper would benefit from the nectar without causing any additional cost to the farmer. So if the government wants to encourage the business of beekeeping, they will also subsidize the farmers to plant more apple trees to provide the necessary nectar.

Research and development are another positive examples of externalities, where the research benefits the greater society far beyond the funding company.

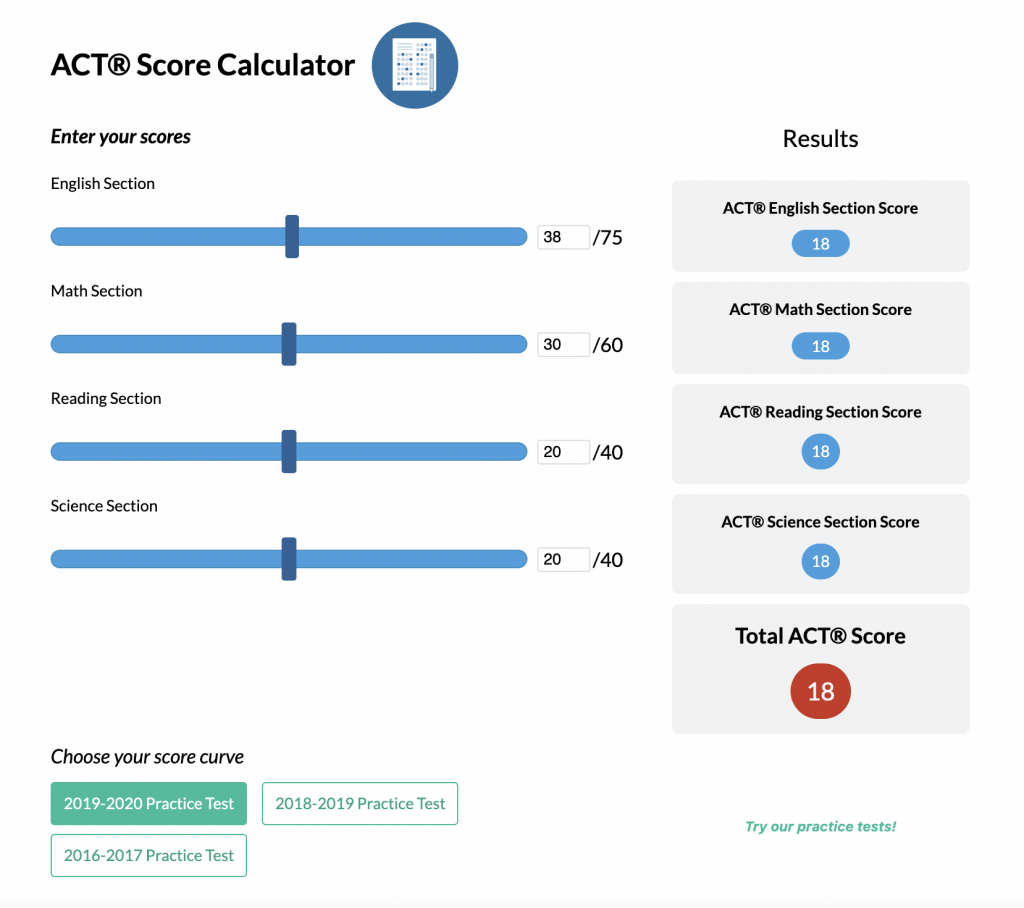

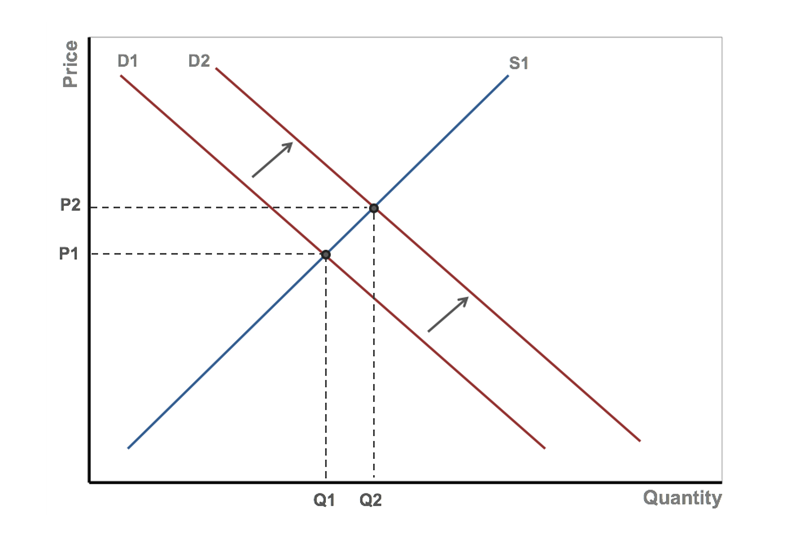

In the positive Externality graph, we face two demand curves, D1 for the private benefit only, and D2 for the public and social benefit.

In this case, the positive externality is produced at Q1 at private benefit only, creating a market failure in the sense that it is below the optimum social benefit. To correct this type of market failure, the government subsidizes the producer to increase production to Q2, where the optimum social equilibrium is.

Deadweight Lost

The deadweight loss that is created in an externality is also called the welfare cost.

By correcting the market failure either in a positive or negative externality, the amount of deadweight loss is reduced by reaching an optimum social equilibrium.

How does this relate to your AP® Microeconomic Exam?

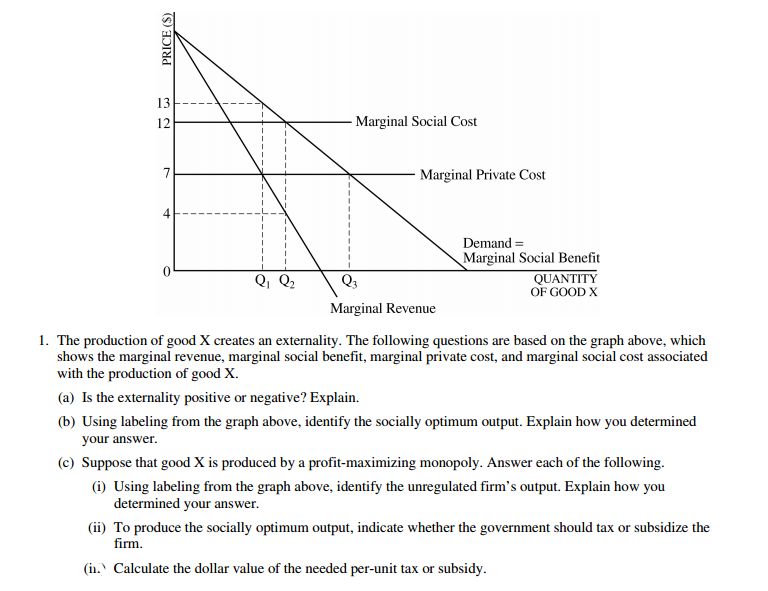

The question of externalities will come up in your AP® Microeconomic exam, and has been in the multiple choice section in previous years as well as in the free response question. Here is an example of an FRQ in 2004.

Image Source: AP® Central – College Board

In this example, the externality is negative because the marginal private cost is greater than the social benefit. The social optimum equilibrium is at Q2 where marginal social benefit and marginal social cost meet and internalizes the market failure.

To answer question C in the example, in a profit-maximizing monopoly, the output margin would be at Q3. This is where marginal private cost meets market demand. The government should tax the firm to reduce the output quantity and increase the cost, to correct the market failure.

The dollar value per unit to be taxed is the difference between Q3 and Q2.

Keep in mind that you may be asked to draw a graph explaining externalities and how they impact the environment, differentiating between negative and positive social benefits. It is a good idea to practice the graph a few times before the exam so you will be confident that you have mastered the skills of externalities. If you feel you need some extra practice, here is a practice test that will help you to reinforce the concepts you are unsure about.

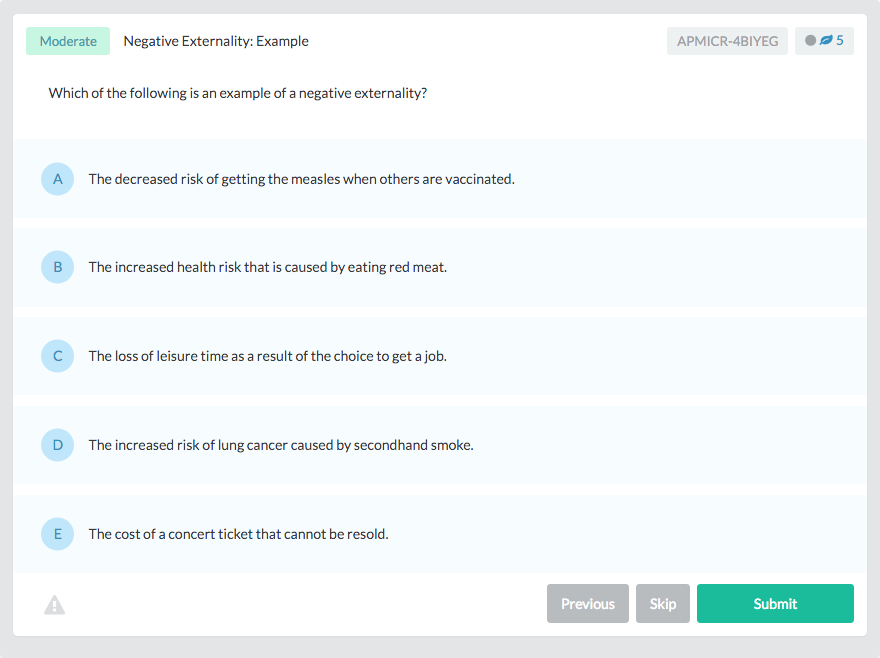

Let’s put everything into practice. Try this AP® Microeconomics practice question:

Looking for more AP® Microeconomics practice?

Check out our other articles on AP® Microeconomics.

You can also find thousands of practice questions on Albert.io. Albert.io lets you customize your learning experience to target practice where you need the most help. We’ll give you challenging practice questions to help you achieve mastery of AP Microeconomics.

Start practicing here.

Are you a teacher or administrator interested in boosting AP Microeconomics student outcomes?

Learn more about our school licenses here.