Welcome to the AP® Macroeconomics crash course on graphing the Short Run Phillips Curve (SRPC)!

What is the Phillips Curve?

The Phillips Curve is really a simple concept. It measures the relationship between inflation and unemployment, or the trade off between inflation and unemployment. The more inflation (aka the higher the prices of goods and services) the lower the unemployment; the lower the inflation (aka the lower the prices of goods and services) the higher the unemployment. Do you see that? It’s a trade-off. In other words, if everybody is employed and making money, the higher prices for goods and services there will be because people will have more money to spend. As a consequence, businesses will raise their prices to make more money because they see people can afford to pay for it (wouldn’t you raise your prices if you thought people were making more money?). But if more people are unemployed, the lower prices will be for goods and services (after all, if nobody has jobs, who is going to buy your products at full price? You’ll have to lower their prices). As a result of this, there is an inverse relationship between inflation and unemployment, meaning the higher the inflation the lower the unemployment and the lower the inflation the higher the unemployment in any given economy.

Why is the Phillips Curve Important?

The Phillips curve is one of the most consequential measurements in all of macroeconomics, arguably second only to GDP. So if GDP is the Most Valuable Player, the Phillips Curve is the Teammate of the Year. If GDP is Batman, the Phillips Curve is Robin. But why is this? It’s because the Phillips Curve measures two important concepts, inflation and unemployment, which help reveal the health of an economy.

How to Graph a Phillips Curve

So how the heck do we graph a Phillips curve? The AP® test will measure your ability to test this, so be sure to remember how to put together this graph. Along the Y axis, inflation is measured and along the X axis, unemployment is measured. The slope of your graph is always downward (and L shaped) because the higher the prices of goods and services (inflation), the lower unemployment. If you think about it conceptually, it makes sense: prices go up when more people have jobs and prices go down when less people have jobs. Just think about it like this: if Bill Gates gave everyone a job worth $1 million per year, businesses would raise their prices (aka “inflation”) because more people could afford more expensive products. On the other hand, if Bill Gates decided to fire everyone, businesses would lower their prices because people couldn’t afford the same goods and services any more. The more you understand this point conceptually, the easier it will be to remember the Phillips curve, how to graph it, and how to understand any type of question the AP® test makers are giving you.

Here’s how this looks on a graph (a Short Run Phillips Curve, or SRPC, and Long Run Phillips Curve, or LRPC):

Please note the Short Run Phillips Curve only measures inflation and unemployment over a short period of time. However, if you want to measure inflation and unemployment over a longer period of time, you will use a Long Run Phillips Curve, or LRPC.

A Few Examples of the Phillips Curve

It is important to note that there are several factors that shift the Short Run Phillips Curve. Decreases in Aggregate Supply shift the Short Run Phillips Curve to the right, for example. Say what? All this means is there will be less goods and services available in the economy in the short run. Common reasons why “aggregate supply” shifts to the right include: an increase in expected inflation; an increase in the price of oil from abroad; a negative supply shock, such as damage from a tornado; and an increase in the minimum wage. But you might be thinking, ok, can you give me an example I can understand and relate to? You know it!

Let’s say fashion companies Nike and Forever 21 have just been given a report that inflation is going to be very high next year, like 10%. With such a dramatic (and expected) increase in inflation, workers at these companies (and companies throughout the economy, including these companies’ suppliers) are going to want to be paid higher wages, which means profits will be smaller once they get their raises. What happens when profits decrease? Workers get laid off because Nike and Forever 21 can’t afford them. This shifts supply to the right (and remember the more rightward shifting on the Phillips Curve, the higher the unemployment will be).

Likewise, if oil increases, if the minimum wage increases, or if there are any NEGATIVE changes to being able to conduct business operations (i.e., a tornado or natural disaster), this will force Nike and Forever 21 (or any companies) to lay off people because they can’t afford them. This shifts aggregate supply to the right. On the other hand, Increases in Aggregate Supply cause the Phillips Curve to shift to the left for the exact opposite reasons why Decreases shift it to the right. In this case, an increase in aggregate supply happens if oil decreases, the minimum wage increases, or if there are any POSITIVE changes in things like technology of supply shock. These sorts of things allow Nike and Forever 21 to hire more workers.

How the Phillips Curve May be Tested on the AP® Macroeconomics Exam

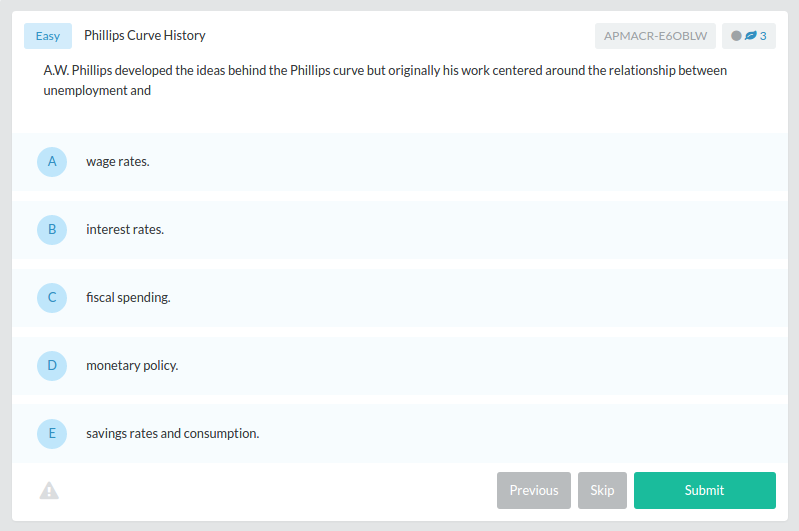

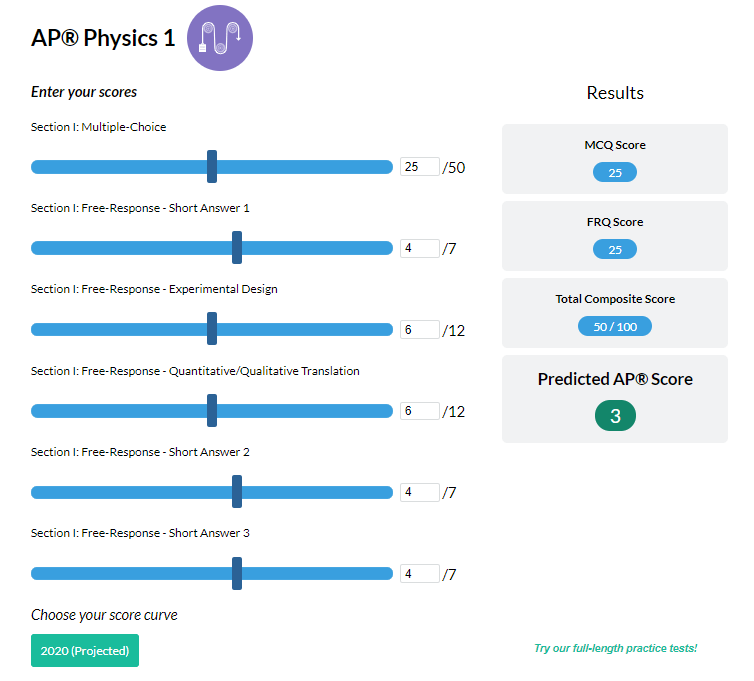

You will have a Multiple Choice Section (Section 1) and a Free Response Question (Section 2). The first part of the test will last for 70 minutes and will account for 66% of your score. The second part of the test will be 60 minutes and will account for the remainder of your score. For the multiple choice section, you could be asked questions like this:

1. Which of the following is the best definition of the concept behind the Phillips Curve?

A. The relationship between worker pay and productivity

B. The relationship between net exports and GDP

C. The relationship between inflation and employment

D. The relationship between supply and demand

And the answer is…C. The Phillips Curve shows the relationship between inflation and employment.

2. As expected inflation increases, the Phillips Curve will

A. Become Vertical

B. Become Upward Sloping

C. Shift to the Left

D. Shift to the Right

And the answer is…D. We know from our earlier example with Nike and Forever 21, if expected inflation increases, workers want higher wages, which will cause these companies not to be able to afford some of them. As a result, some workers will be laid off, which produces higher unemployment along the rightward side of your Phillips Curve.

3. Suppose that there is an increase in the price of oil that affects the domestic economy. Which direction will the SR Phillips Curve shift?

A. A shift of the LRPC to the Right

B. Shift of the SRPC to the left

C. Shift of the SRPC to the right

D. Movement along the SRPC

And the answer is…C. The Short Run Phillips Curve always shifts to the right if there is an increase in the price of oil that affects the domestic economy. This is because higher oil prices make it more expensive to do business (just like higher oil prices make it more expensive to drive a car), which creates higher unemployment and shifts your Phillips Curve.

For the Free Response part of the exam, you will always have 3 questions. Question 1 will always be the long FRQ and we would recommend spending 25 minutes on it. It is best to draw your graphs to help you better and more quickly figure out the answers (for this question and each question thereafter). Always remember, too: do not be intimidated by the content (i.e., the specific information they ask you to solve), just use the formulas you have studied in class and in your test prep to plug and play. And if all else fails, use your logic. You are like a detective when solving the FRQ section. But be sure to be CLEAR with your responses and write them CLEARLY (you can get docked for not making your answer known and for unintelligible handwriting).

Just go into the test knowing that you have prepared as much as you can and use your intelligence and logic to think through the multiple choice and FRQ and you will be just fine. But remember, the SRPC is one of the most important concepts in macroeconomics, and measures the short-term relationship between inflation and unemployment, and the LRPC measures the long-term relationship between inflation and unemployment.

Wrapping Up the Short Run Phillips Curve

The Short Run Phillips Curve (SRPC) is an easy concept to understand if you remember that inflation and unemployment are inversely related. If inflation goes up, unemployment goes down. If unemployment goes up, inflation goes down. This is almost always true in the short run. Think of the SRPC in specific terms, like if you own a business and everyone has a lot of money, you will charge people more for your product. When you charge more, you will have more profits, can hire more employees (to help grow your business), and so on. Higher prices equals more inflation, which equals lower unemployment.

Let’s put everything into practice. Try this AP® Macroeconomics practice question:

Looking for more AP® Macroeconomics practice?

Check out our other articles on AP® Macroeconomics.

You can also find thousands of practice questions on Albert.io. Albert.io lets you customize your learning experience to target practice where you need the most help. We’ll give you challenging practice questions to help you achieve mastery of AP Macroeconomics.

Start practicing here.

Are you a teacher or administrator interested in boosting AP Macroeconomics student outcomes?

Learn more about our school licenses here.