Are you preparing for your AP® Microeconomics exam and need to reinforce your understanding of the different market structures? In this AP® Microeconomics monopoly crash course review, you will learn about the monopoly market structure with examples, and practice the graph to better understand the industry.

What is a Monopoly?

A monopoly is a market structure where one company or seller has complete control over the market, and has very limited to no competition, often resulting in high prices and low quality products.

Pure monopolistic companies rarely exist. In legal terms, a monopoly power exists when a single firm controls about 25% or more of the market.

Monopolies form for various reasons. When a firm has exclusive ownership of a certain resource, it has monopoly power over that resource and therefore it is the only firm that can exploit that resource.

Sometimes the government grants a firm a monopoly status in specific areas such as the post office, or the government grants a patent to one specific company, granting monopoly power to companies such as Microsoft or other digital media, design, characters or images.

A natural monopoly is when there is extreme high fixed cost of distribution, or when large-scale infrastructure is required to ensure supply such as cables for electricity supply. This eliminates competition because it makes it almost impossible for new firms to enter the market. To decrease the potential to exploit this monopoly power, governments tend to either nationalize or regulate natural monopolies.

Monopolies can also be created by merging two or more companies. Merging companies reduces competition, and if the merger creates a market share of 25% or more of the total market, a monopoly is formed. A monopoly can violate antitrust laws when it destroys the competition or the ability of other companies to enter the market.

A monopoly is different from a perfectly competitive market, given that it has very low to no competition. Another difference is that the competition between monopolies is in product differentiation rather than in price competition. It is the opposite of an oligopoly, which is a market structure in which one buyer has many sellers.

To recognize a monopolistic market structure, it is important to know the characteristics. Here are the most common characteristics of a monopoly.

What are the Characteristics of a Monopoly?

- Profit maximizer – by raising cost and producing less then social optimum output

- Super-normal profits in the long run.

- Price maker – they set the price for lack of competition

- High barriers to entry – normally requires high startup cost

- Single seller – one seller with many buyers

- Price discrimination – can charge different prices to different clients

- Product differentiation – distinguishes its products or services from the competition

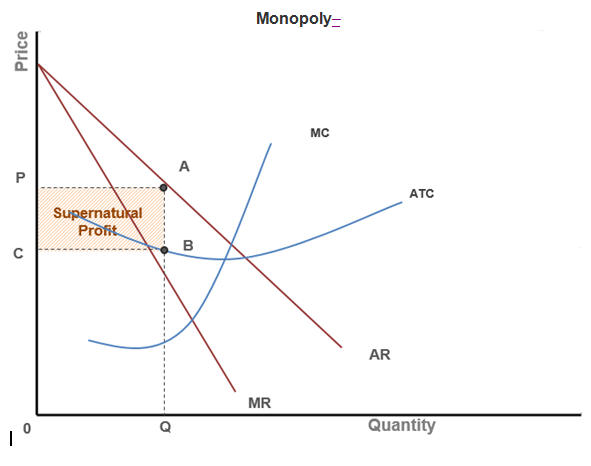

A monopoly is a profit maximizer because it equalizes its marginal revenue with marginal cost. In other words, the output will be where MC = MR, given that price is above ATC at Q, a long run super-normal profit is possible.

The economic of scale in a monopoly (AR in the graph) is where the output increases and the long run average cost falls.

To put this better in contest let’s look at an example. Apple built a factory at a high fixed capital cost to build its products. The more products they produce in that factory, the lower their average cost per unit will be. As seen in the graph, if the firm increases output to Q1, it will have lower average cost. Smaller firms with a lower output have a higher average cost, and are unlikely to survive in the industry.

Economies of Scale

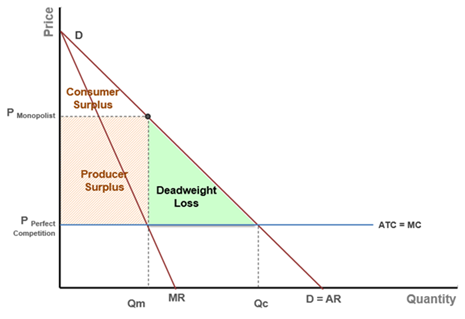

Monopolies are less efficient than perfectly competitive markets and are productively inefficient. A monopoly market maximizes production to where their MC equals MR. This results a less quantities produced than a perfectly competitive market would produce, and the producers supply their goods below their manufacturing capacity.

Since the price of the product in a monopoly is higher than the marginal cost, the market becomes allocative inefficient.

As a price setter, a monopoly gets to charge whatever they want without market influence. To maximize profit, the price is set where production level falls on the demand curve. When the price is exceeding the firms marginal cost, the consumer pays a higher price than in a perfectly competitive market.

Producers sell less units at a higher price than a competitive market, creating deadweight loss, consumer and producer surplus.

Monopoly

Price discrimination in a monopoly occurs when the firm charges a different price to different consumers. In a monopoly with price discrimination, the firm produces an output that is allocative efficient, charging different prices to different clients, thereby eliminating consumer surplus and maximizing profit.

The difference between monopolistic competition and perfect competition is in the way they compete with each other. In a perfect competition, firms compete with the same product and different prices. In a monopoly, the competition is a non-price competition, based solely on product differentiation. Product differentiations is the process where one firm distinguishes its product or service from the competition in order to attract more customers.

Sometimes the government will impose a tax to a monopolistic firm to reduce production, and at other times it subsidizes to increase production to a socially optimal output. When the government imposes a tax per unit produced, the MC curve moves to the left, decreasing quantity and raising price. By raising the price, the tax is actually paid for by the consumers. When government wants to increase the output quantity, it subsidizes the monopoly, bringing the MC curve to the right, and price down and increasing quantity to the socially optimum level.

How does this relate to the AP® Microeconomics Exam?

Monopoly market power always comes up in the exam, either in the multiple choice section of the exam or in the FRQ section. In fact, almost every year there is one question about a monopolist market in the FRQ section. Here is an example from the exam in in 2009.

Image Source: AP® Central – College Board

In the first paragraph we see that CableNow is the only supplier of cable TV services, unregulated, making economic profit, and does not practice price discrimination. This tells us that CableNow is a monopolistic firm with no competition. The graph that we need to draw looks like this:

Monopoly

a. The profit maximizing quantity is at Q*, the difference between MC and ATC is the profit earned marked with P*. Socially optimal level is at Qs where the Mc curve intersects the demand curve.

b. the lump sum subsidy will have no impact on the quantity of services produces, and will not affect MC.

c. QR is where the ATC curve and demand curve intersect, and identifies the quantity of cable services.

d. Accounting profit is possible and excludes implicit costs.

e. the socially optimal quantity will be larger than Qs

After reading this crash course and practicing the graphs a few times, you should be good to go for the exam. Here is a link to a practice test which is aligned with the College Board, where you can test your readiness for the exam.

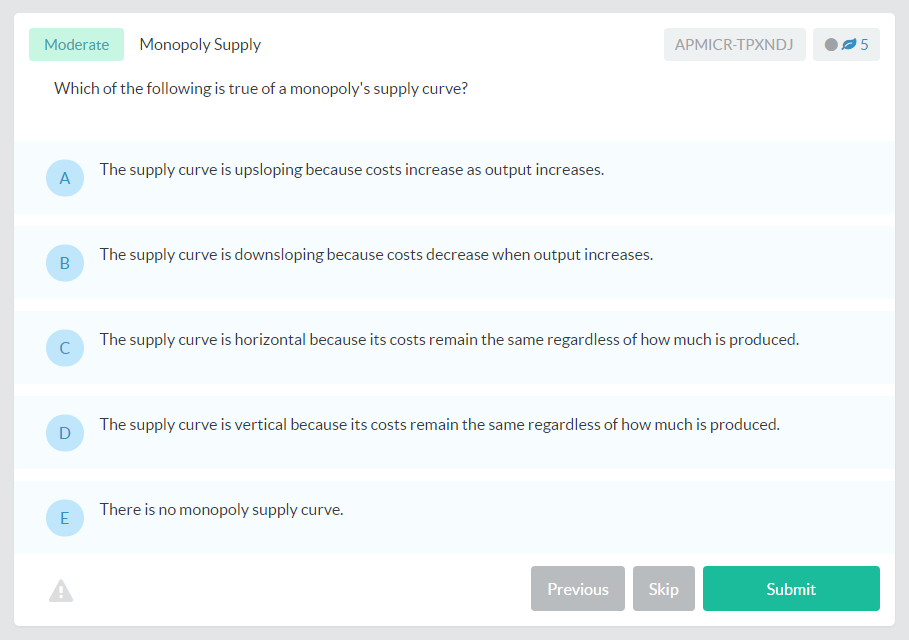

Let’s put everything into practice. Try this AP® Microeconomics practice question:

Looking for more AP® Microeconomics practice?

Looking for more AP® Microeconomics practice?

Check out our other articles on AP® Microeconomics.

You can also find thousands of practice questions on Albert.io. Albert.io lets you customize your learning experience to target practice where you need the most help. We’ll give you challenging practice questions to help you achieve mastery in AP® Microeconomics.

Start practicing here.

Are you a teacher or administrator interested in boosting AP® Microeconomics student outcomes?

Learn more about our school licenses here.